Squeezed For Cash? 5 Quick Ways To Increase Your Cash Flow

Is your property portfolio putting your cash flow in a vice? If you’re squeezed for cash because of your investments – and if you’re investing in property, that’s the worst place to be – its probably because you have a negatively geared portfolio.

Sound accurate?

Don’t worry – you aren’t alone. According to the Australian Bureau of Statistics, in 2005, over two-thirds of investors had negatively geared properties. Ouch! That’s 67% of investors losing money from property.

In 2011, negatively geared properties cost $13.2 billion. $13.2 billion. Imagine what you could do with $13.2 billion…

Of course, you can claim negative gearing on tax, and try to save some of your money from the government – but you have to be on a huge salary to benefit from that! The average Aussie can’t afford negative gearing.

Don’t worry – we’ve got 5 Cash Flow Solutions right here to help free you from financial struggle – and that nasty negative portfolio!

1. Debt Management

Debt – especially uncontrolled debt – is one of the most damaging things you can do to your cash flow.

Wipe out your debt – especially your bad debt – and you immediately improve your cash flow and expand your lifestyle choices.

Get started now:

If you haven’t already, speak with a professional property finance expert to be sure that your portfolio is working as hard for you as it can.

Create a workable budget that you can live with. Don’t be too rigid but also challenge yourself to see how much you can save and conversely how little you can spend. Make a game of it and you just might surprise yourself.

Ring up your bank(s) and negotiate interest rate cuts on your credit cards. If the costs are not excessive try to get the interest on your investment and home loans slashed too.

Release any equity you may have and then use the cash directly to reduce your debts or use it to buy positive cash flow property, depending upon where you’re at financially and what your goals are.

Take a close look at your offset account(s). Have you been dipping into it when you shouldn’t? Remember that it’s for your future and dip into the capital only for investment needs.

Put all of your income into a single, interest bearing account and live off your credit card, provided it has at least a 45-day grace period. Then, pay it off in its entirety each and every month to avoid paying any interest.

2. Positive Gearing Using Your Tax Deductions

Book an appointment – if you haven’t already – with an accountant who is experienced in the tax laws surrounding property investment.

If you’re a PAYG earner, claim your tax deductions on a continual basis; either weekly, fortnightly or monthly, and put those monies straight into your offset account where compounding interest can work its magic.

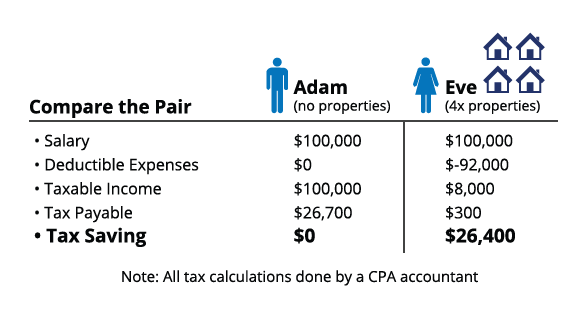

Then, depending upon your personal situation, add more investment properties to increase your wealth. Take a look at the following example:

As you can see, investment properties can significantly reduce your tax liability, shrinking the amount of tax that the ATO can collect!

3. Buy Positive Cash Flow Properties

Begin by looking for areas with strong market drivers:

Infrastructure spending

Economics

Supply (low) and demand (high)

Demographics

Rental Yield (5%+)

Population Growth

Using one or more strategies; renovation, second income stream, subdivision, strata and/or a straight-up discount purchase you can put together great positive cash flow deals right out of the gate!

The key is knowing what to look for:

In areas where units are in demand find a property that needs just a bit of surface renovations. Be sure to include renovation costs when making your offer.

A duplex or small block of units can be strata titled, which can really boost your equity in a fairly short amount of time. This is because you’re forcing value, rather than waiting for the market to do it for you.

Homes typically appeal to families, so if the area demographic goes after houses find properties that can support a subdivision or renovations – perhaps even both – for a positive return.

Don’t be afraid to invest in other states. Not only will you speed up the rate at which your portfolio will grow (because you’re not having to wait on the market cycle), you’re greatly expanding your choice of good investment opportunities.

Quickly determine the potential GROSS yield of a property by doing the following:

Weekly rent x Weeks in the year = Annual rent divided by purchase price x 100

$320pw x 52 = $16,640 / $200,000 = 0.0832 x 100 = 8.32% gross yield

To calculate the net yield you’ll follow the same formula, however you’ll deduct the actual expenses of the property (not including the interest you pay) before dividing the rent by the purchase price:

Annual rent – property expenses divided by purchase price x 100 = net yield

4. Trade Real Estate

Getting a good deal when trading real estate begins when you purchase the property. The idea is to of purchasing the property. Here’s how:

Buy at a discount

Hold onto the property and add use an add value strategy to force equity

Sell when the market is at it’s hottest

5. Use Equity Growth As Cash Flow

Find markets where the capital growth is consistently strong and then use the equity the market delivers to fund more deals and to cash flow your lifestyle.

Shoot for equity of $30,000 to $50,000, which can be used to service your properties, add to your portfolio and fund your lifestyle.

It’s certainly possible to find properties where the equity is already built into the property. In a fast growing marketplace you can tap into that equity in about 12 months time and add to your account where compound interest can get to work growing it even more.

Click here to like us on Facebook and see more updates like this.

Hey there, do you enjoy the Positive Real Estate Blog? If you did, why don’t you book into a Property Information Night in your area and get more information from our team. You can do so here.

Also, if you can not wait, click here to access the Property Mini Course and signup for our email newsletter. This FREE 2 hours video series gives you some of the top tips from our team that you can use right now. Thanks.

Take the Next Step

Are You Making One of These 5 Common Budget Mistakes?

Budgeting, together with saving is the foundation of every successful wealth creation plan. If you don’t know where your money is going, and if you’re not diligently saving it, you’ll lack the resources to build a comfortable future for yourself and your loved ones. A…

Co-own your investment property? Here’s what you need to know about tax

The following article has been supplied by the ATO containing tips related to your investment property.

Do You Have Wealth Creation Habits?

Studies of habits and their close cousin, willpower, have been done, giving us insight into how people form – and keep – habits.

5 Golden Rules For Building Your Investment Property Portfolio

Like anything else in life, learning how to buy property for investment takes time and effort, but the benefits you’ll receive far outweigh the effort you need to put in. To help ease the learning curve a bit it’s helpful to have a few hard and fast rules to keep the…

5 Property Investing Myths that Kill Investors’ Futures

If you’ve been investing in houses you’re probably listening to advice you’ve come across and believe to be true. But is it? Just because something is considered “common wisdom” that doesn’t necessarily mean that it’s entirely true. It may be only partly true or it…

Beginning property investors are often so absorbed with finding an investment property that will deliver good capital growth and/or positive cash flow that they forget the very important matter of protecting those assets. Protecting your wealth is no less important…

2 Big Fears Property Investors Face

Buying investment property to grow your wealth is a well proven strategy. So why then is it so scary for many would-be investors? A number of reasons, but in my opinion, the two biggest reasons people are afraid to invest in property are: The large amount of money…

How To Negotiate “Like a Boss”

You can find a great investment property, in a growth location, and still miss out on positive cash flow because you weren’t able to negotiate a price and terms that worked for you. If you’re not comfortable negotiating for what you want or if you’d simply like to…

5 Quick Tips For a Stress Free Retirement Plan

The superannuation balance of Australians is dismal. Men have on average $183,000 in their accounts whereas women have barely more than half that – $93,000. In fact, only 10% of Australians have in excess of $100,000 in their super! Obviously then, lots of…

Is a Structural Renovation Right for Your Investment Property?

At Positive Real Estate, we provide “time proven” property investing information and advice. We work directly with property investors throughout Australia, helping them reach their wealth creation goals. Recently, Bupa Landlord Insurance showcased us in a post on the…

The post Squeezed For Cash? 5 Quick Ways To Increase Your Cash Flow appeared first on Positive Real Estate.

Read more: positiverealestate.com.au