Remember how you felt during the financial crisis in 2008?

People were scared.

Even the professionals were uncertain about what might happen.

I know, because I was scared, too.

But I couldn’t show it.

Whatever was going on, my clients still needed me to provide thoughtful advice and to help stop them from doing something stupid.

At that point in my career, I’d survived the market dip in 1998 and handled Y2K.

Even during the tech bubble, I didn’t panic.

But the situation in 2008-9 was different.

I felt it, and my clients felt it.

I still remember the exact moment when my uncertainty trumped my confidence.

It happened at the end of a meeting with some longtime clients.

They were really nervous and wanted to know, “What should we do?”

The best answer I could give them wasn’t very satisfactory.

“Stay the course,” I told them.

This advice was based on a couple of things

One, they had a well-designed portfolio, and it made zero sense to sell into a down market.

And two, the weighty evidence of history suggested it was the best advice I could give them.

After discussing their situation for a little longer, they took confidence in my confidence.

But to this day, I remember leaving that meeting and thinking, “Man, I hope I’m right.”

Not long after, a good friend called me.

After years of hard work, he was close to wrapping up the sale of his business.

The amount of money involved would mean a comfortable life for him and his family — if it was managed wisely.

He wanted to know how I thought he should invest the money.

But uncertainty weighed so heavily on me that for the first time in my career I said, “I don’t know.”

At the time, I felt like I was the only one feeling this fear and uncertainty.

But the researchers Bradley Klontz and Sonya Britt conducted a study that revealed many financial planners weathering the financial crisis “were emotionally distraught and were calling into question their basic assumptions about how to help clients reach their financial goals.”

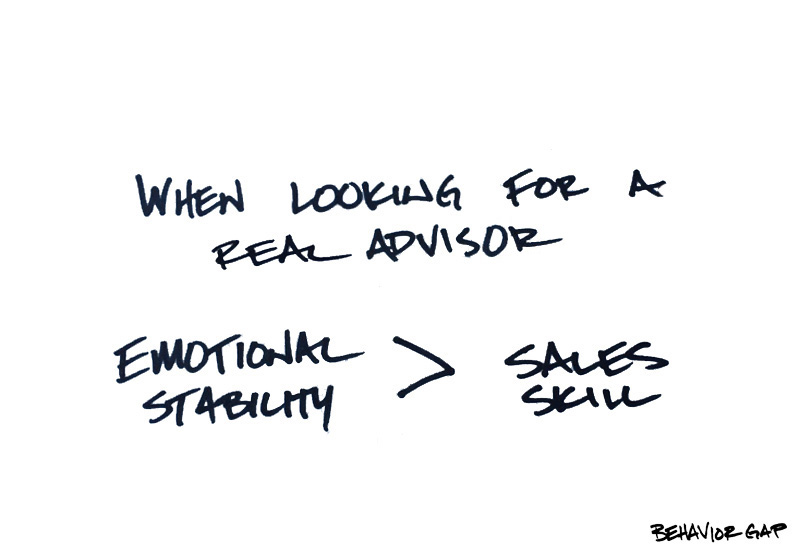

What many of us experienced in 2008-9 introduces something new to think about when you’re hiring a financial advisor or planner.

Specifically, how well does he or she deal with uncertainty?

Because here’s the thing: We can reduce some of our financial risk

But there’s still irreducible risk left over from events we cannot predict and life events we cannot control, and that creates uncertainty.

How does an advisor or planner deal with this irreducible uncertainty?

And if we consider an advisor’s behavior and performance in this area an important criterion, how do we measure it?

An important question to ask the advisor is: Walk me through any changes in your investment process over the last 10 years.

People forget things, but the great thing about financial advice is that we leave a trail of our decisions.

Professionals who have been in the business should be able to trace the advice they shared with clients.

How did their advice change over time?

The warning signs you’re looking for are disclosures of major changes every two or three years.

When I say major, I mean something like switching from tactical asset management (picking stocks or asset classes that they expect to outperform other parts of the market) to buying-and-holding one year, and then back again in the next.

That can be a sign that financial advisors aren’t exactly sure what they’re doing.

Subtle tweaks around the edges are to be expected, and they may even be a good sign that this person is willing to adapt as things change.

But let’s be clear: There’s a big difference between thoughtful changes and random, hard-to-explain changes.

By asking this question, you can gain a sense for how this person deals with uncertainty.

Do they look for ways to tweak around the edges and adapt?

Or do they toss everything aside and hope that the next new thing will work better?

Read more: propertyupdate.com.au