window.googletag = window.googletag || {cmd: []};

googletag.cmd.push(function() {

googletag.defineSlot(‘/21854739906/PUAds’, [320, 480], ‘div-gpt-ad-1591951428937-0’).addService(googletag.pubads());

googletag.defineSlot(‘/21854739906/scnativead’, [‘fluid’], ‘div-gpt-ad-1606480494583-0’).addService(googletag.pubads());

googletag.defineSlot(‘/21854739906/SCNativebot’, [‘fluid’], ‘div-gpt-ad-1607089901157-0’).addService(googletag.pubads());

googletag.defineSlot(‘/21854739906/SentDiff’, [[320, 480], [580, 400]], ‘div-gpt-ad-1592314976732-0’).addService(googletag.pubads());

googletag.defineSlot(‘/21854739906/WealthRetreatM’, [300, 250], ‘div-gpt-ad-1614694819642-0’).addService(googletag.pubads());

googletag.defineSlot(‘/21854739906/WelthRetreatAndrewM’, [300, 250], ‘div-gpt-ad-1614692082542-0’).addService(googletag.pubads());

googletag.defineSlot(‘/21854739906/WRKen’, [300, 250], ‘div-gpt-ad-1591952574147-0’).addService(googletag.pubads());

googletag.defineSlot(‘/21854739906/WRMichael’, [300, 250], ‘div-gpt-ad-1614692298007-0’).addService(googletag.pubads());

googletag.defineSlot(‘/21854739906/WRPete’, [300, 250], ‘div-gpt-ad-1614692396886-0’).addService(googletag.pubads());

googletag.defineSlot(‘/21854739906/WRTom’, [300, 250], ‘div-gpt-ad-1614692503260-0’).addService(googletag.pubads());

googletag.defineSlot(‘/21854739906/WRDiff’, [[300, 250], [580, 400]], ‘div-gpt-ad-1614691717334-0’).addService(googletag.pubads());

googletag.defineSlot(‘/21854739906/WADiff’, [[300, 250], [580, 400]], ‘div-gpt-ad-1591954226942-0’).addService(googletag.pubads());

googletag.defineSlot(‘/21854739906/WAAll’, [300, 250], ‘div-gpt-ad-1591954430768-0’).addService(googletag.pubads());

googletag.defineSlot(‘/21854739906/PMDiff’, [[320, 480], [580, 400]], ‘div-gpt-ad-1591955248601-0’).addService(googletag.pubads());

googletag.defineSlot(‘/21854739906/PMAll’, [320, 480], ‘div-gpt-ad-1591955561642-0’).addService(googletag.pubads());

googletag.defineSlot(‘/21854739906/BYHAll’, [320, 480], ‘div-gpt-ad-1591955823345-0’).addService(googletag.pubads());

googletag.defineSlot(‘/21854739906/BYHDiff’, [[320, 480], [580, 400]], ‘div-gpt-ad-1591956110394-0’).addService(googletag.pubads());

googletag.defineSlot(‘/21854739906/MPAll’, [300, 250], ‘div-gpt-ad-1591961806038-0’).addService(googletag.pubads());

googletag.defineSlot(‘/21854739906/MPDiff’, [[300, 250], [580, 400]], ‘div-gpt-ad-1591962148719-0’).addService(googletag.pubads());

googletag.defineSlot(‘/21854739906/MMAll’, [300, 250], ‘div-gpt-ad-1591962591418-0’).addService(googletag.pubads());

googletag.defineSlot(‘/21854739906/MMDiff’, [[300, 250], [580, 400]], ‘div-gpt-ad-1591962513851-0’).addService(googletag.pubads());

googletag.defineSlot(‘/21854739906/MelbDiff’, [[320, 480], [580, 400]], ‘div-gpt-ad-1591963125912-0’).addService(googletag.pubads());

googletag.defineSlot(‘/21854739906/MelbAll’, [320, 480], ‘div-gpt-ad-1591962859656-0’).addService(googletag.pubads());

googletag.defineSlot(‘/21854739906/BrisbDiff’, [[320, 480], [580, 400]], ‘div-gpt-ad-1591963608964-0’).addService(googletag.pubads());

googletag.defineSlot(‘/21854739906/BrisbAll’, [320, 480], ‘div-gpt-ad-1591963452542-0’).addService(googletag.pubads());

googletag.defineSlot(‘/21854739906/SydDiff’, [[320, 480], [580, 400]], ‘div-gpt-ad-1591964270831-0’).addService(googletag.pubads());

googletag.defineSlot(‘/21854739906/SydAll’, [320, 480], ‘div-gpt-ad-1591963993486-0’).addService(googletag.pubads());

googletag.defineSlot(‘/21854739906/PDAll’, [320, 480], ‘div-gpt-ad-1591965401096-0’).addService(googletag.pubads());

googletag.defineSlot(‘/21854739906/PDDiff’, [[320, 480], [580, 400]], ‘div-gpt-ad-1591965559837-0’).addService(googletag.pubads());

googletag.defineSlot(‘/21854739906/RHPHDiff’, [[320, 480], [580, 400]], ‘div-gpt-ad-1591966343056-0’).addService(googletag.pubads());

googletag.defineSlot(‘/21854739906/RHPHAll’, [320, 480], ‘div-gpt-ad-1591966099982-0’).addService(googletag.pubads());

googletag.defineSlot(‘/21854739906/BooksAll’, [[300, 250], [320, 480]], ‘div-gpt-ad-1591967275697-0’).addService(googletag.pubads());

googletag.defineSlot(‘/21854739906/BookingDiff’, [[580, 400], [320, 480]], ‘div-gpt-ad-1592478409212-0’).addService(googletag.pubads());

googletag.defineSlot(‘/21854739906/MMDPPAll’, [320, 480], ‘div-gpt-ad-1599568850982-0’).addService(googletag.pubads());

googletag.defineSlot(‘/21854739906/MMDPPDiff’, [[320, 480], [580, 400]], ‘div-gpt-ad-1599568940250-0’).addService(googletag.pubads());

googletag.defineSlot(‘/21854739906/NIPAll’, [320, 480], ‘div-gpt-ad-1599569002292-0’).addService(googletag.pubads());

googletag.defineSlot(‘/21854739906/NIPDiff’, [[580, 400], [320, 480]], ‘div-gpt-ad-1599572187548-0’).addService(googletag.pubads());

googletag.defineSlot(‘/21854739906/Andmirams’, [300, 250], ‘div-gpt-ad-1612269270436-0’).addService(googletag.pubads());

googletag.defineSlot(‘/21854739906/MarkCreedon’, [300, 250], ‘div-gpt-ad-1612269503026-0’).addService(googletag.pubads());

googletag.defineSlot(‘/21854739906/kuest’, [300, 250], ‘div-gpt-ad-1615181511684-0’).addService(googletag.pubads());

//googletag.pubads().enableSingleRequest();

googletag.pubads().collapseEmptyDivs();

googletag.enableServices();

});

Will Covid Delta derail our property markets?

The answer is NO according to the latest ANZ Bank research.

Our housing markets remain in very good shape with national house prices continuing to rise strongly, even in Sydney where increasing levels of mobility restrictions have been in place since June.

According to ANZ, u ltra-low interest rates, high savings buffers and ongoing fiscal support are likely to continue to support the housing market.

ltra-low interest rates, high savings buffers and ongoing fiscal support are likely to continue to support the housing market.

In fact ANZ have bumped up their 2021 forecasts a little.

Since March the bank has been forecasting house price gains of between 15-20% across the capital cities, but our property markets have performed more strongly than they expected.

They now forecast average capital city housing prices to rise just over 20% in 2021.

However, ANZ expect that price gains will moderate from the hectic pace of the first half of this year, given the increased uncertainty around the outlook, slightly higher fixed mortgage rates, and the prospect of macroprudential measures.

And then they are expecting average price gains of 7% in 2022. Still very respectable growth!

Currently, our property market remains tight.

As sales continue to outpace new listings, leaving stock levels very low property prices will continue to rise.

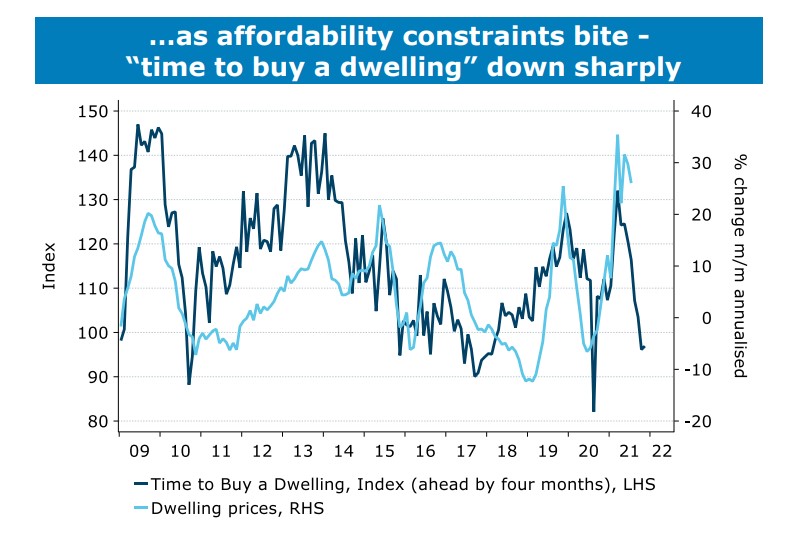

But ANZ anticipates some slowdown in price growth over the coming months, driven by slightly higher mortgage rates, decreasing affordability, and the potential for macroprudential tightening.

Finance commitments suggest price growth ahead.

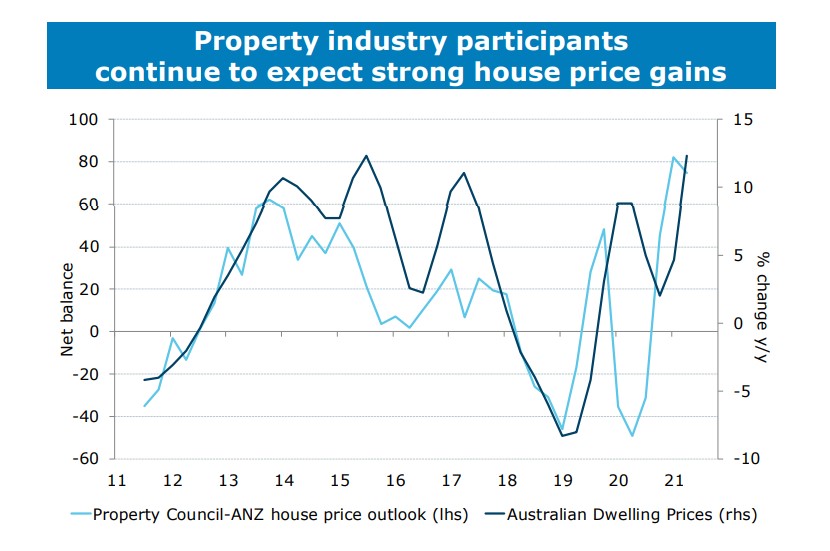

While owner-occupiers were early drivers of this property cycle, investor lending is now surging.

googletag.cmd.push(function() { googletag.display(‘div-gpt-ad-1591951428937-0’); });

Over the six months to June, investor lending rose 55% and has more than doubled since June last year.

While still running at a solid clip, owner-occupier lending has slowed a little, largely because of a pull-back by first home buyers.

Over the six months to June, lending to first home buyers fell 3%, while lending to other owner-occupiers rose 23%.

Overall, though, momentum in housing finance is slowing after a year of stellar growth.

Moving forward affordability constraints are likely to bite and this will see first home buyer lending continue to drift lower.

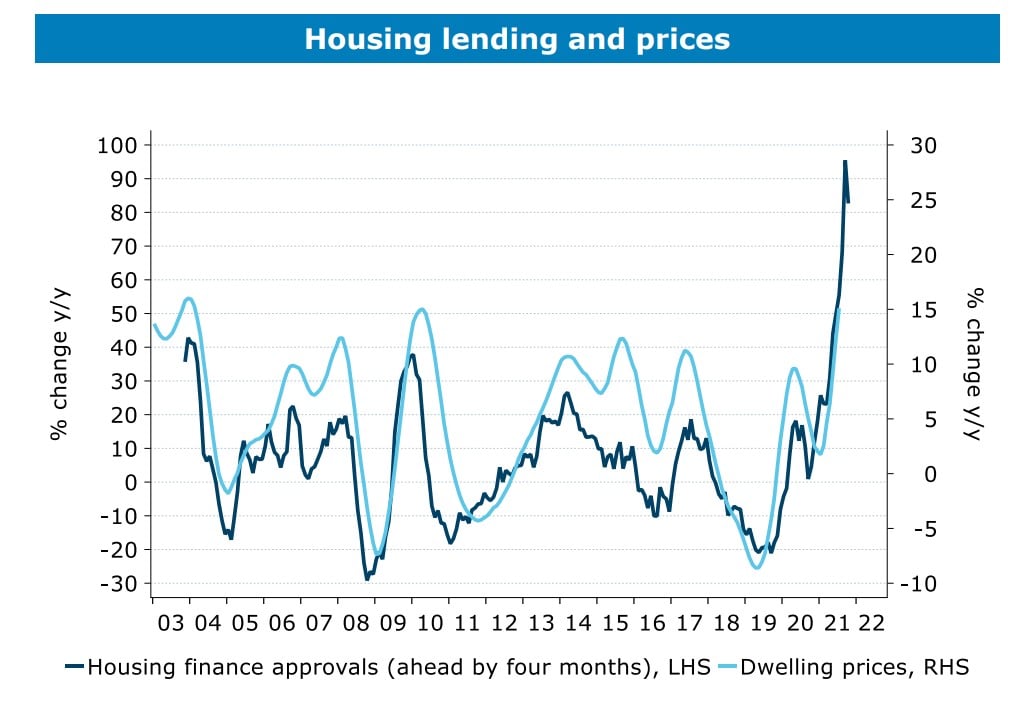

However housing finance rose 83% in the year to June, and while the housing finance is coming off the boil, house prices look to continue to rise solidly, as housing lending is a leading indicator and property values tend to rise 3 to 6 months after finance approval is obtained.

The following chart shows what is likely to happen to house prices moving forward based on recent finance approvals.

While Delta is having an impact , it’s not enough to reverse the trend

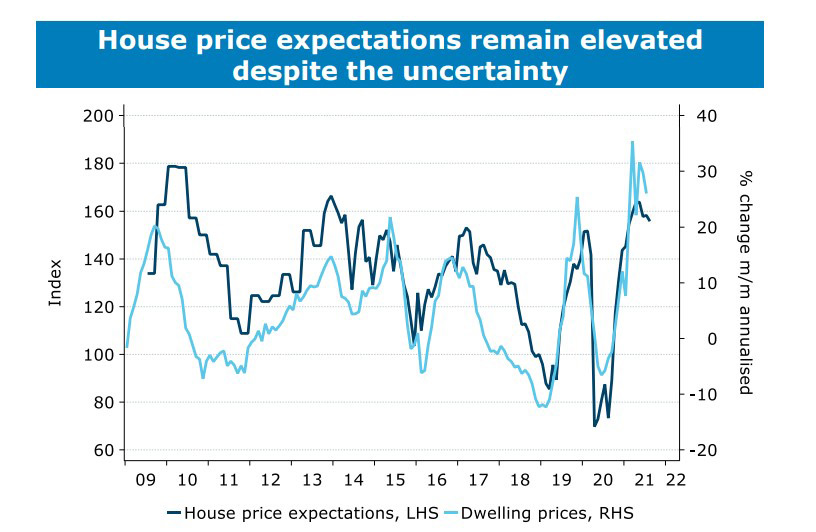

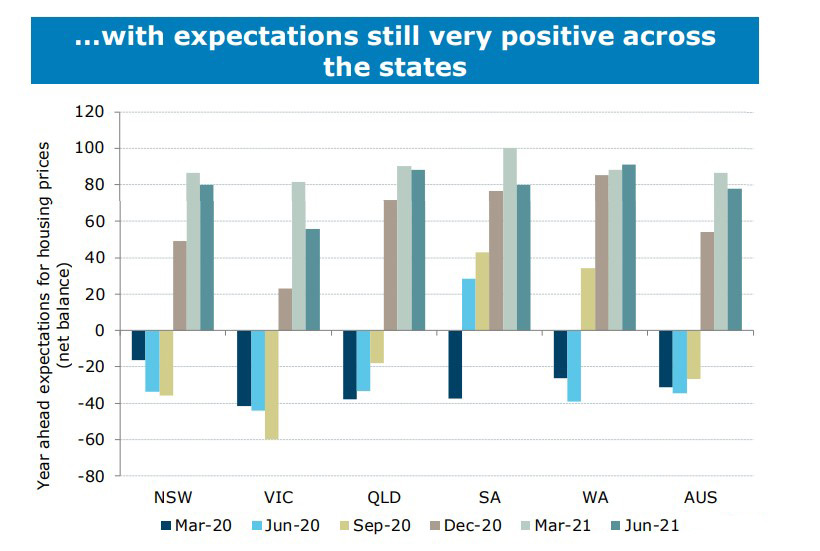

The following charge from ANZ Bank show the resilience of our housing market despite all the current issues.

A

A ANZ report that overall, households and businesses remain upbeat about the house price outlook as more property investors are returning to the market and auction clearance rates remain strong

ANZ report that overall, households and businesses remain upbeat about the house price outlook as more property investors are returning to the market and auction clearance rates remain strong

We expect price gains to moderate in 2022

Now is the time to take advantage of the opportunities the current property markets are offering

Sure the markets are moving on, but not all properties are going to increase in value. Now, more than ever, correct property selection will be critical.

You can trust the team at Metropole to provide you with direction, guidance, and results.

Whether you’re a beginner or an experienced investor, at times like we are currently experiencing you need an advisor who takes a holistic approach to your wealth creation and that’s exactly what you get from the multi-award-winning team at Metropole.

We help our clients grow, protect and pass on their wealth through a range of services including:

Strategic property advice – Allow us to build a Strategic Property Plan for you and your family. Planning is bringing the future into the present so you can do something about it now! Click here to learn more

Buyer’s agency – As Australia’s most trusted buyers’ agents we’ve been involved in over $4Billion worth of transactions creating wealth for our clients and we can do the same for you. Our on the ground teams in Melbourne, Sydney, and Brisbane bring you years of experience and perspective – that’s something money just can’t buy. We’ll help you find your next home or an investment-grade property. Click here to learn how we can help you.

Wealth Advisory – We can provide you with strategic tailored financial planning and wealth advice. Click here to learn more about we can help you.

Property Management – Our stress-free property management services help you maximise your property returns. Click here to find out why our clients enjoy a vacancy rate considerably below the market average, our tenants stay an average of 3 years, and our properties lease 10 days faster than the market average.

googletag.cmd.push(function() { googletag.display(‘div-gpt-ad-1592314976732-0’); });

Read more: propertyupdate.com.au