Understandably, the coronavirus crisis is creating uncertainty for those interested in the Brisbane property market.

Brisbane’s property downturn in 2018-9 was quite shallow compared to the big two capital cities and following its recent upturn property values have reached a new peak.

However, Brisbane property prices are still about 55% of Sydney’s while household incomes are only around 12% lower, underpinning the value of Brisbane real estate.

However, Brisbane property prices are still about 55% of Sydney’s while household incomes are only around 12% lower, underpinning the value of Brisbane real estate.

But what’s going to happen to the Brisbane housing market moving forward?

In general Queensland is highly exposed to the Chinese economy, in particular tourism, education and foreign property purchases.

This means the Queensland property markets are likely to suffer.

On the flipside, once travel bans are lifted, the Queensland economy and property market should benefit from more local travel by Australians as it is likely that overseas travel will still be restricted.

Not all Brisbane property will be impacted equally

Clealry there is not one Queensland property market.

Regional Queensland is likely to be heaps worst while Brisbane real estate market is underpinned by multiple pillars, and therefore likely to suffer less than the Gold Coast and Sunshine Coast or regional Queensland.

And even Brisbane does not have ‘one’ property market.

Based on the predicted pace of the post-recession recovery, I would expect the pandemic to have a more limited and shorter-lived impact on house prices than either the early-1990s recession or the Global Financial Crisis.

So, in the short term:

So, in the short term:

“Investment grade” properties and A grade (above average) homes could fall in value by around -5%

B grade (average) homes could fall in value by up -10%,

C grade (less than perfect) will be the hardest hit as there will be a flight to quality.

But this will be on a on very low levels of transactions and he pace of recovery from that point will depend on the state of the wider economy.

The worst affected market will be the more expensive properties that will suffer because of the stock market crash.

And properties in the blue-collar areas and new housing estates where young families are likely to have overextended themselves financially and with many people will be out of work for a while.

On the upside, households and property investors whose incomes remain stable and secure will be able to take advantage of historically low interest rates.

This should support a return to stronger levels of price growth in the medium term.

One of the major lessons I have learned from previous downturns is the importance of taking a long-term perspective which always outsmarts short-term reactive thinking.

And for mine, it’s always property fundamentals that really matter and drive our markets in the long term.

Things like demographics, supply and demand, affordability, availability finance, and local economic trends.

Of course, we all know the old saying, being fearful when others are greedy and be greedy when others are fearful….

But it’s normal human nature to find it difficult to buy your new home or invest when everyone else is running around thinking the world is coming to an end.

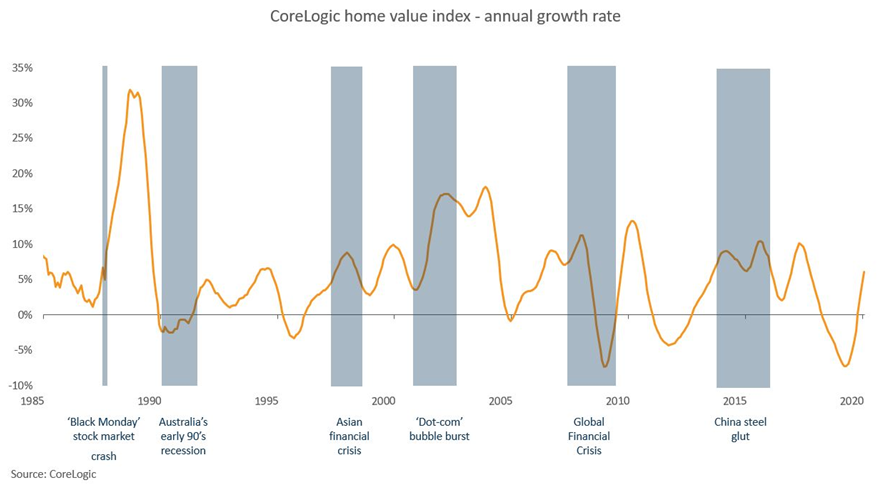

The following chart shows how Australian residential property has historically fared well against negative economic shocks

The banks are becoming cautious

Just as Brisbane was finally soaking up its oversupply of new and off the plane properties, the COVID-19 induced social distancing and lock down regulations will bit its p market.

This has caused some banks to become more cautious and more reluctant to lend to new or off the plan properties in selected Brisbane postcodes by lowering the maximum loan to value ratio.

These postcodes include:Chermside, Hamilton, Milton, Toowong, Woolloongabba and Biggera Waters

What about vacancies?

The latest quarterly Domain Rent Report, placed Brisbane as one of the country’s most stable rental markets up until March.

Domain senior research analyst Dr Nicola Powell said the call for foreign residents and tourists to return home amid the rise of desperate renters facing job losses had sparked the last-minute surge in rental vacancies with a drop in asking rentals destined to follow.

The Domain Rental report further revealed that as of March, 2020, Brisbane houses offered a gross rental yield of 4.6 per cent while units offered a slightly stronger yield of 5.4 per cent.

Brisbane’s rental listings rose 7 per cent from March 16 to April 5, compared to the same time last year, while across Queensland those listings rose 27 per cent from March 23 to 29, compared to the previous four weeks.

Dr Powell said the latest data indicated the state’s tourism hot spots would be hardest hit with first the bushfires and now the pandemic set to particularly affect rental markets on the Sunshine Coast, the Gold Coast and other tourist magnets such as the Whitsundays.

For more information read more here: COVID-19 and the impact on landlord insurance

What is the Queensland tenant relief scheme?

A raft of new measures aimed at protecting tenants and financially supporting their landlords will be introduced in Queensland.

The Queensland government will ban landlords from requiring tenants to draw down their superannuation or sell large personal assets like cars to pay their rent, and they will not be able to request personal financial information, among other measures.

Housing Minister Mick de Brenni said the current crisis was no one’s fault, and the new system would give landlords and tenants an opportunity to work out tenancy issues themselves.

This package was designed to bridge the gap and help renters waiting for their Centrelink applications to come through.

A one-off payment of up to 4 weeks rent (maximum of $2,000) will be available to eligible tenants who do not have access to other financial assistance, with the grant paid directly to their landlord.

To be eligible, applicants must live in Queensland, have a bond or shortly have a bond with the Residential Tenancies Authority, have less than $10,000 in cash and savings, and have applied to Centrelink for income support if they’ve lost their jobs.

Further, these tenants must have first tried to negotiate a payment plan with their landlord.

Now read: Coronavirus and our property markets – what should you be doing now?

REIQ demands protection of $1 trillion Queensland property market

In the face of the COVID-19 pandemic, the Real Estate Institute of Queensland (REIQ) has outlined a number of urgent priority areas it is seeking action on to assist in maintaining the health of Queensland’s property market.

The real estate body’s CEO, Antonia Mercorella, highlighted that the state’s real estate sector is worth over $1 trillion and directly employs more than 50,000 Queenslanders.

“Activity within the real estate sector contributes in excess of $30 billion every year to the Queensland government,” she outlined.

“Protecting and sustaining the Queensland real estate sector is critical to safeguarding our property market and supporting our local economy. In order to do so, strong action needs to be taken.”

The Real Estate Institute of Queensland (REIQ) is seeking urgent action from the Queensland State Government to assist in maintaining the stability of the Queensland property market in the face of the economic impacts of the coronavirus (COVID-19) pandemic.

The REIQ has proactively developed a set of recommendations and proposed initiatives that will assist in minimising the potential economic impacts of the coronavirus (COVID-19) on the real estate sector.

In order to maintain stability and optimism in the Queensland property market during the coronavirus (COVID-19) pandemic, the REIQ is urgently asking the Queensland State Government to:

Extend the First Home Buyers Grant to established housing: Expanding the First Home Buyers Grant beyond new construction will stimulate economic activity through the introduction of increased numbers of first home buyers to the broader property market.

Implement a 50% reduction in development application costs across all Local Governments and introduce streamlined application processes: Removing barriers to development and reducing costs will assist to boost construction levels, increase competition and importantly, reduce cost for the end purchaser.

Deliver a 75% reduction in stamp duty for the period of the coronavirus (COVID-19) pandemic: A short-term, but significant, reduction in stamp duty payable on property transactions will have a positive effect on confidence within the property market. This, in turn, will offset the predicted drop in real estate transactions expected during the immediate crisis period.

Lessening the financial burden of stamp duty in particular will lessen the perceived financial risk and act as a significant incentive to purchasers who may otherwise be discouraged from purchasing during this crucial period.

Similarly, such an initiative would encourage vendors to list their properties during the coronavirus period, buoyed by the likelihood of increased buyer activity.

In the 18 months following the end of the coronavirus (COVID-19) pandemic, the REIQ are urgently seeking the following further stamp duty related reforms to continue to support and stimulate the property market, which include:

Removal of stamp duty for persons aged 65+ years: This will encourage older Queenslanders to move into age-appropriate accommodation by reducing the financial burden of such a move. A likely consequence of this would be greater access to housing stock for younger Queenslanders.

A 50% reduction in stamp duty where residential investment property purchases are committed to the permanent rental market in Queensland for 3 years or more: A significant reduction in stamp duty for residential investment properties will have the effect of stimulating property investment in Queensland.

A 40% reduction in stamp duty for all other residential property purchases: A significant reduction in stamp duty payable on non-investment residential property purchases will have the effect of instilling confidence into the property market and provide incentive to individuals Australia-wide to consider migration to Queensland.

In calling for a 50% reduction in stamp duty for property purchases committed to the permanent rental market for 3 years or more (b), a natural consequence of the Prime Minister’s rental eviction moratorium and similar measure introduced to combat the financial impacts of the coronavirus (COVID-19) is that property investors (current or prospective) are likely to lose confidence in residential real estate as a viable investment option.

Queensland has rapidly growing residential rental demand, a situation likely to be exacerbated by the financial impacts of the coronavirus (COVID-19).

The combination of increased rental demand and decreased property investment is a looming social time bomb.

More than 90% of Queensland residential investment property supply is provided by ‘mum and dad’ investors who are most likely to be sensitive to increased risk to their property investment returns.

A significant decrease in stamp duty payable on residential investment properties, qualified by enforceable commitment by investors to making that property available to the permanent rental market, will have the dual effects of stimulating investment confidence and activity.

It will position Queensland as a highly attractive investment market and ensure adequate supply is maintained to meet increasing demand.

To support property owner generally impacted by potential reductions in rental income, and households financially impacted by the coronavirus (COVID-19), the REIQ is also urgently requesting the Queensland State Government to facilitate the following:

Provide a significant reduction or temporary removal of land tax for the period of the coronavirus (COVID-19) pandemic;

Waive local government rates for those who have lost their income as a result of this crisis; and,

Implement a 50% discount on local government rates to assist household budgets and assist in stimulating the Queensland economy.

The REIQ believes that it isn’t enough to put money in people’s pockets during this time; instead, we need maintain confidence in the Queensland property market and assist the real estate sector to ride out this crisis and emerge stronger and more resilient for the benefit of all Queenslanders.

The REIQ fundamentally believe these relief package measures will keep Queenslanders employed within the State’s second largest employment sector, keep essential services functioning at this critical time, and most importantly accelerate our State economy’s recovery once this crisis has passed.

NOW READ: Is now a good time to buy property?

Now is the time to take action and set yourself for the opportunities that will present themselves as the market moves on

If you’re wondering what will happen to property in 2020–2021 you are not alone.

You can trust the team at Metropole to provide you with direction, guidance and results.

In challenging times like we are currently experiencing you need an advisor who takes a holistic approach to your wealth creation and that’s what you exactly what you get from the multi award winning team at Metropole.

If you’re looking at buying your next home or investment property here’s 4 ways we can help you:

Strategic property advice. – Allow us to build a Strategic Property Plan for you and your family. Planning is bringing the future into the present so you can do something about it now! This will give you direction, results and more certainty. Click here to learn more

Buyer’s agency – As Australia’s most trusted buyers’ agents we’ve been involved in over $3Billion worth of transactions creating wealth for our clients and we can do the same for you. Our on the ground teams in Melbourne, Sydney and Brisbane bring you years of experience and perspective – that’s something money just can’t buy. We’ll help you find your next home or an investment grade property. Click here to learn how we can help you.

Wealth Advisory – We can provide you with strategic tailored financial planning and wealth advice. Click here to learn more about we can help you.

Property Management – Our stress free property management services help you maximise your property returns. Click here to find out why our clients enjoy a vacancy rate considerably below the market average, our tenants stay an average of 3 years and our properties lease 10 days faster than the market average.

NOW READ: What’s ahead for Brisbane’s property market?

Read more: propertyupdate.com.au