Unemployment has been in the headlines a lot this week after the ABS released its April employment estimates.

The ABS estimate 12,419,000 Australians were employed in April, down 594,000 on March.

There were sharp falls for both full-time and part-time employed.

The ABS estimate Australian unemployment increased by only 104,000 to 823,000 in April (6.2% of the workforce, up 1%).

The team at Roy Morgan, who regularly bring out their own unemployment stats, questions the accuracy of these figures suggesting ….

Australians will be asking, how can the ABS say 594,000 Australians have lost their jobs in April but only 104,000 become unemployed?

This is because the ABS claim 490,000 people left the workforce in April. i.e. the ABS claims these people lost their jobs and were not then looking for work and available to start work during the reference week.

These workers are unemployed – NOT out of the workforce.

So the workforce size in April should match the March estimate of 66%.

Roy Morgan suggests that the real ABS unemployment estimate for April is closer to 1.35 million (9.8%) – an increase of 4.6% points on March.

Combined with the estimated ABS under-employment of 1.82 million (13.7%) this leads to a combined unemployment and under-employment of 3.16 million (23.5%).

This is much closer to the latest Roy Morgan April employment estimates which showed 2.16 million Australians (15.3%) were unemployed and a total of 3.48 million (24.7%) were either unemployed or under-employed.

It is also important to understand that the Federal Government estimate around 6 million Australians are on JobKeeper and the ABS considers these Australians to be employed – whether they are currently working or not – so it is not JobKeeper which has caused this very low estimate of unemployment.

The workers who are now on JobKeeper but are working for reduced hours are significantly boosting the level of under-employment in the Australian economy.

The ABS has captured this with their under-employment estimate increasing by 608,000 to 1.82 million.

The first JobKeeper payments made by the ATO were distributed only recently, in the first week of May.

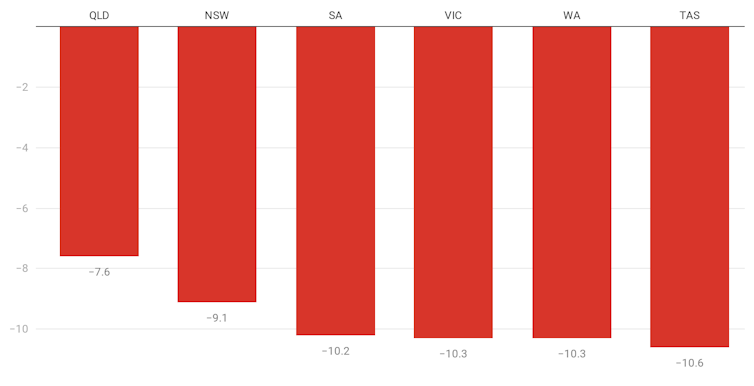

Percentage fall in hours worked

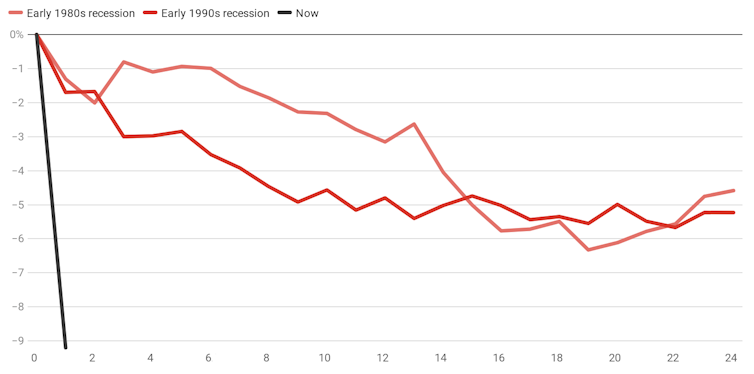

Total hours worked fell 9.2% – in just one month, between March and April.

Months from start of recession. Author’s calculations from ABS 6202.0

Months from start of recession. Author’s calculations from ABS 6202.0

The scale and speed are difficult to comprehend.

By comparison, in the major recessions of the 1980s and 1990s, hours worked fell by 6% – but after 18 months.

Women have been hurt more than men, losing 11.5% of the hours worked in March, compared to men who lost 7.5%.

Queensland and NSW have so far fared better than other states.

Percentage fall in hours worked by state:

Predictions of much bigger job losses for the young than the old have been proved correct.

Workers aged 15 to 24 losing about 11% of employment compared to 3.4% for those aged 25 to 54, and 4.3% for the over 55s.

The official rate of unemployment in April 2020 rose to 6.2%. This is the highest rate since July 2015.

What really happened to unemployment in April?

On May 1, 2020 Roy Morgan released accurate real employment and unemployment estimates for the whole of April.

Roy Morgan’s unemployment estimate showed a massive 2.16 million Australians were unemployed (15.3% of the workforce) and this was in fact down from late March – when unemployment peaked at 2.4 million (16.8%).

These April unemployment estimates captured the impact of the introduction of JobKeeper on March 30 which kept many Australians attached to their employer rather than become unemployed.

In April there were a total of 3.48 million Australians (24.7%) either unemployed or under-employed, and this was down from the high of 3.92 million (27.4%) in late March.

Why does it Matter?

If we believe the ABS April unemployment release (does anyone?) and don’t read the fine print, when Australia went into lock-down many Australians did not become unemployed – they simply decided to leave the workforce.

If we believe Roy Morgan many Australians lost their jobs and/or had hours reduced.

The Roy Morgan estimates show that the drastic Government action that was taken in late March/early April did prevent Australia from plunging into a deep ‘depression’ as bad as or worse than 90 years ago.

If you’re going by the numbers make sure they’re the right numbers!

Now is the time to take action and set yourself for the opportunities that will present themselves as we move through the Coronavirus Cocoon.

If you’re wondering what will happen to property in 2020–2021 you are not alone.

You can trust the team at Metropole to provide you with direction, guidance and results.

In challenging times like we are currently experiencing you need an advisor who takes a holistic approach to your wealth creation and that’s what you exactly what you get from the multi award winning team at Metropole.

If you’re looking at buying your next home or investment property here’s 4 ways we can help you:

Strategic property advice. – Allow us to build a Strategic Property Plan for you and your family. Planning is bringing the future into the present so you can do something about it now! This will give you direction, results and more certainty. Click here to learn more

Buyer’s agency – As Australia’s most trusted buyers’ agents we’ve been involved in over $3Billion worth of transactions creating wealth for our clients and we can do the same for you. Our on the ground teams in Melbourne, Sydney and Brisbane bring you years of experience and perspective – that’s something money just can’t buy. We’ll help you find your next home or an investment grade property. Click here to learn how we can help you.

Wealth Advisory – We can provide you with strategic tailored financial planning and wealth advice. Click here to learn more about we can help you.

Property Management – Our stress free property management services help you maximise your property returns. Click here to find out why our clients enjoy a vacancy rate considerably below the market average, our tenants stay an average of 3 years and our properties lease 10 days faster than the market average.

Read more: propertyupdate.com.au